I agree to and consent to receive news, updates, and other communications by way of commercial electronic messages (including email) from Tectonic metals. I understand I may withdraw consent at any time by clicking the unsubscribe link contained in all emails from Tectonic metals.

Tectonic Drilling Discovers Low-angle Pogo-style Quartz Veining To 9.95 G/T Au Over 0.75m And Intersects Visible Gold At Tibbs Gold Project

Highlights and Key Takeaways

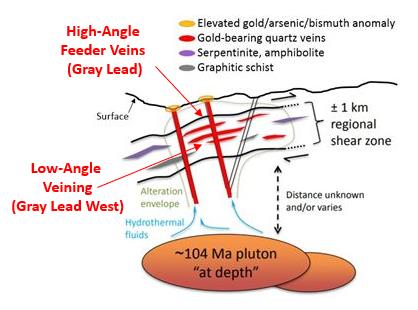

- Discovery at Tibbs: Drilling at Gray Lead West confirms for the first-time low-angle veins carrying Pogo-style gold mineralization (Au-As-Bi-W-Te geochemical signature), intersecting gneiss-hosted quartz-sulphide veins with visible gold

- Pogo Analogue: Tibbs exhibits high-angle veining (Gray Lead) adjacent to newly discovered low-angle veins (Gray Lead West), both carrying high-grade Pogo-style gold mineralization confirmed by drilling

- All key elements of the Pogo Exploration Model are now present at Tibbs further validating the application of the Model

- See Pogo-Tibbs comparison table below and geological cross-section here

- Four stacked, low-angle, Pogo-style quartz vein horizons discovered at the Gray Lead West target, with highlights including:

- 9.95 g/t Au over 0.75m at 223.00m down hole and 7.64 g/t Au over 0.60m at 342.70m down hole in diamond hole TBDD21-012

- 2.21 g/t Au over 3.04m at 120.40m down hole in Reverse Circulation hole TBRC21-003

- Veins are interpreted to dip gently (~20-30 degrees) to the west, are blind to surface, and are believed to correlate along trend with an upper structure in hole TBDD21-012, defining nearly 700m of potential trend

- Visible gold intersected in TBRC21-001, 450m west of hole TBDD21-012 returning 1.37 g/t Au over 3.05m

- In light of Tectonic’s previous “gold nugget effect” news release (see here), Tectonic is now processing this hole and other drill holes containing visible gold via metallic screen fire assay

- Consistent with the Pogo Geological Model, Gray Lead West is interpreted to connect to the immediately adjacent Gray Lead vein, an interpreted high-angle feeder zone. Gray Lead exhibits 250m of mineralized strike, is drill tested to only 120m vertical, and open in all directions

- High drilling density at Pogo indicates that vein mineralization rapidly pinches and swells over short (~20 to150m) distances (see Pogo East Deep Plan Map here)

- Potential for increased vein thickness and stacking at Gray Lead West along trend with additional drilling. Surface geochemistry and geophysical lineament analysis suggest a much larger system may be present

- For plan maps, assay sheets, drill collar information, and cross-sections relating to Tectonic’s 2021 Phase II drilling at Tibbs, please see here

- Next steps: Follow-up drilling at the Gray Lead West target to focus on identifying additional, thicker intervals of vein-hosted, Pogo-style gold mineralization

VANCOUVER, B.C., March 10, 2022 – Tectonic Metals Inc. (TECT: TSX-V; TETOF: OTCQB; T15B: FSE) (the "Company" or "Tectonic") today announced the results from its 2021 Phase II oriented diamond core and Reverse Circulation (“RC”) drilling campaign at the Tibbs Gold Project (“Tibbs”), located less than 35 kilometers (“km”) from Northern Star Resources’ (ASX: NST) Pogo Gold Mine (“Pogo”). Phase II drilling was primarily designed to test the previously unexplored gneissic rocks in the western half of the project area through a campaign of widely spaced reconnaissance drill holes in four distinct structural blocks. Additional drilling was conducted at the Tibbs South area to follow up on high-grade rock grab samples collected during the summer season; a total of 23 drill holes for 4,216m were completed in Phase II. Targets were generated by the Company’s TITAN-160 DCIP/MT survey, surficial geochemistry, lineament analysis and interpretations from magnetic and EM data.

Tony Reda, President and CEO, commented, “After multiple explorers and years of trying, the elusive low-angle quartz veins carrying Pogo-style gold mineralization have now been discovered at Tibbs. To appreciate the significance of this finding, one must understand the history, geology and exploration model of Pogo and how it relates to Tibbs. Gold at Tibbs was originally discovered in high-angle veins at the Grey Lead Zone, where drilling intersected 34.04 g/t Au over 3.81m in hole BM9810 in 1998 by the same group that discovered the nearby Pogo Mine, with a discovery intercept of 16.73 g/t Au over 7.62m in hole POGO-1 in low-angle veins in 1994. It was not until 2013 that an updated Pogo Exploration Model was published stating that high-angle veins carrying gold mineralization have now been found at Pogo and are interpreted to feed the low-angle veins. At Pogo, low-angle veins were discovered first followed by high-angle veins second, while at Tibbs the opposite occurred: high-angle veins were discovered first, followed by low-angle veins second. Is Tibbs Pogo? Well, no; however, understanding Pogo is vital to understanding Tibbs; even more so now that all the elements of the Pogo Exploration Model are confirmed at Tibbs. Our drill discovery of multiple stacked intervals of high-grade, low-angle veining represents an excellent exploration opportunity to delineate the extent of the Tibbs’ Gray Lead system and test for areas of increased grade and thickness. We are encouraged by the fact that at Pogo, veining can rapidly pinch and swell over minimal distances along trend and the same may be true of Tibbs. Do the newly discovered low-angle and the previously discovered high-angle veins at Tibbs have the economic widths and grades to make a mine? We do not know yet, but we are willing to take that bet and continue drilling to answer that question.”

Gray Lead West – A Pogo Analogue

A total of 959.2m of drilling in 4 holes was completed at the Gray Lead West (“GLW”) target, a previously untested target analogous to main-stage vein mineralization at Pogo. Diamond hole TBDD21-012 intersected four intervals of low-angle, ~20 to 30-degree west-dipping quartz veins with highlight results of 9.95 g/t Au over 0.75m at 223.00m down hole and 7.64 g/t Au over 0.60m at 342.70m down hole. The vein intervals exhibit the same morphology, mineralogy, and Au-As-Bi-W-Te geochemistry as the high-angle Gray Lead vein just 300m to the east, which is interpreted as a feeder vein to the low-angle veins intersected in hole TBDD21-012.

Additionally, RC drill hole TBRC21-003, located 700m to the west of hole TBDD21-012, intersected quartz vein-hosted mineralization grading 2.21 g/t Au over 3.04m, 120.4m below surface. This interval appears to be correlative along a low angle structure with visible gold (“VG”) observed in RC hole TBRC21-001, which returned 1.37 g/t Au over 3.05m, and an interval of quartz veining grading 0.39 g/t Au over 1.52m in hole TBRC21-002. The mineralization intersected in the RC holes is believed to correlate along trend with a vein in hole TBDD21-012, defining nearly 700m of potential strike between holes. The vein mineralization drilled at GLW is the best example of low-angle quartz vein-hosted gold found in the Goodpaster Mining District outside of the Pogo footprint and was intersected where predicted by the Pogo Geological Model (the “Model”; see Table 1 and Figure 1 below. Link to Model here).

Publicly available data from exploration drilling at Pogo completed by Sumitomo from 2009 - 2011 indicates that vein mineralization at the shallowly dipping East Deep target at Pogo rapidly pinches and swells, with “blow outs” occurring over short distances where structures which host veining dilate due to secondary structural controls (see East Deep Plan Map here). Where intersected by a diamond hole during the 2021 campaign by Tectonic, vein intervals exhibit high gold grades, the correct sulphide assemblages, Au-As-Bi-W-Te geochemical signatures, and low-angle orientations. As observed in the Pogo East Deep discovery case study, additional drilling along trend of each vein intersection at GLW is warranted to delineate the extent and geometry of this system and test for areas of increased grade and thickness.

Figure 1: The Pogo Exploration Model, modified after Twelker, 2017.

Table 1 Comparison between mineralization at the Pogo Mine and that observed at the Gray Lead West and Gray Lead Zones at Tibbs. Information from Larimer, 2016.

| CHARACTERISTIC | POGO | TIBBS – GRAY LEAD WEST | TIBBS – GRAY LEAD |

| Structural Orientation | Low-angle, stacked veins (Liese, East Deep) & high-angle feeder veins (North Zone, X Vein) | Low-angle, stacked veins. Four structures/veins intersected | High-angle feeder vein; adjacent and related to Gray Lead West |

| Typical Vein Thickness | Liese: 0.3->20m, North Zone & X Vein: ~1-4m | 0.61m, 0.75m drilled thickness | 1-4m true thickness |

| Drilling | >125,000m from 1994-2006 | 959m total, single pierce point into deep high-grade veins | 4,171m from 1998-2021 |

| Alteration Assemblages | Qtz-sericite, biotite | Qtz-sericite, biotite | Qtz-biotite |

| Carbonate Alteration | Fe-dolomite in/near veins | Fe-dolomite in/near veins | Fe-dolomite in/near veins |

| Gold Fineness | ~900 | Unknown | Unknown |

| Primary Sulphides | Aspy Bis ± Po | Aspy Bis ± Po | Aspy Bis |

| Late Stage Mineralization | As-Sb Sulphides | As-Sb Sulphides | As-Sb Sulphides |

| Tungsten Mineralization | Scheelite in skarns and veins | W in proximal veins | W in proximal veins |

| Bismuth Mineralization | Strong Au Correlation | Strong Au Correlation | Strong Au Correlation |

| Tellurium Mineralization | Au Correlation | Au Correlation | Au Correlation |

| Fluid Chemistry | CO2, low salinity | Unknown | CO2 rich, low salinity |

| Age of Mineralization | 104.2 Ma | Unknown | ~102 Ma |

| Sulphur Isotopes | Unknown | Unknown | Unknown |

| Homogenization Temp. | 310-570 C | Unknown | 260-455 C |

| Current Deposit Model | Plutonic-related Au | Plutonic-related Au | Plutonic-related Au |

Western Targets – Galosh, Johnson Saddle, West Trench

Phase II reconnaissance drilling was also conducted at the following Tibbs targets: Galosh, Johnson Saddle, West Trench, and Wolverine. Drilling indicates that the southwestern extent of the property exhibits potential for multiple, kilometre-scale vein targets which require additional drilling. A map showing Phase II drilling activity at Tibbs may be found here.

Galosh

At Galosh, two reconnaissance RC drill holes spaced 600m apart were drilled into a 1,200 x 1,200m soil anomaly centred along a gneissic ridgeline 2.4km north of Gray Lead. Quartz vein-hosted mineralization was intersected in hole TBRC21-007, with a highlight of 2.44 g/t Au over 3.05m beginning at 164.59m down hole in an interval of strong silica-sericite alteration. Gold mineralization grading 0.96 g/t Au over 3.05m beginning at 19.81m down hole was intersected in hole TBRC21-008, located 600m to the east. Anomalous arsenic accompanies vein mineralization at the target area, and additional step out drilling is warranted to determine the extent and orientation of the mineralized intervals.

Johnson Saddle

At Johnson Saddle, a high-tenor gold and arsenic-in-soil anomaly hosted by gneissic rocks is situated 1,400m north of Gray Lead and adjacent to a high-angle, northeast-trending controlling fault structure. Potential was recognized for low-angle mineralized structures in the gneissic rocks to the west of the fault structure. During the Phase II drilling, one diamond hole (TBDD21-011) and one RC hole (TBRC21-009) were completed. A package of west-dipping gneissic rocks with local intervals of amphibolite and thin slivers (~2-4m) of altered ultramafic rocks was intersected, with low angle, west-dipping shearing and faulting observed in multiple locations throughout hole TBDD21-011. Multiple intervals of gold mineralization were intersected in the diamond hole, including an interval of 5 cm thick quartz veins within a low-angle shear feature grading 1.61 g/t Au over 2.00m with associated bismuth and arsenic anomalism beginning at 105m down hole. In RC hole TBRC21-009, located 50m to the east, intersected a structure with anomalous arsenic and antimony grading 3.43 g/t Au over 1.52m beginning at 38.1m down hole. The interval is coincident with a logged shear zone grading 0.76 g/t Au over 0.85m at 56.00m in hole TBDD21-011 and defines a low-angle mineralized structure dipping ~20 degrees to the west.

West Trench

Drilling at the West Trench target consisted of a combination of two diamond drill holes (TBDD21-009, TBDD21-010) and three RC holes (TBRC21-004 to 006) targeting prominent high-angle structures within a previously untested gold-arsenic-bismuth-antimony soil anomaly. Drilling in the central portion of the target confirmed the presence of controlling high-angle fault structures adjacent to low-angle fractures and structurally controlled alteration zones. Results include 0.35 g/t Au over 10.00m in hole TBDD21-010 in a high-angle, sulphidic fault zone at 240.00m down hole, and 1.25 g/t Au over 1.40m (including 150 ppm Bi) in hole TBDD21-009 beginning at 16.60m down hole. TBRC21-005, an overcut of hole TBDD21-010, intersected 0.96 g/t Au over 3.05m (including 40.3 ppm Bi over the interval) from 109.73m down hole. TBRC21-006, the easternmost hole at the target designed to drill beneath a high-grade (190.4 g/t Au) quartz vein grab sample, intersected an interval of quartz veining grading 0.31 g/t Au over 4.57m at 96.01m down hole, with significant arsenopyrite and pyrite observed in chip samples. Additionally, specks of visible gold were noted within the interval during chip logging. The interval is currently being subjected to a metallic screen fire assay in light of the gold nugget effect at the nearby Michigan Zone (see news release here).

Wolverine

At the Wolverine target, hole TBDD21-008 drill tested a fault structure with coincident gold-in-soil and electromagnetic anomalies along a prominent air photo linear feature. The borehole drilled through altered granodiorite and diorite intrusive consisting of fault gouge and rubble for the entirety of the hole, with mineralization peaking at 0.65 g/t Au over 2.00m, beginning at 114.00m down hole. Drilling at Wolverine by both Tectonic (2021) and historical operators (1997) has yet to explain the source of the high-tenor, 1,200m x 600m surficial gold and pathfinder element anomaly at this target.

Tibbs South – Jorts and Jeans Targets

At Carrie Creek, high-grade sheeted quartz-gold-bismuthinite veining (to 50.3 g/t Au) similar to that observed at Kinross Gold’s Fort Knox Mine was found in granodiorite talus blocks along a 400m northeast-southwest trend at the Jorts target (see news release here). Five RC holes were completed at the Jorts target, with granodiorite-hosted gold mineralization associated with weak to moderate chlorite alteration and increased bismuth, tungsten, and tellurium intersected in four holes. Highlights include 1.21 g/t Au over 1.53m from 169.16m and 0.44 g/t Au over 6.10m from 126.49m down hole in CCRC21-006, 1.79 g/t Au over 1.53m from 156.97m down hole in CCRC21-008, and 0.33 g/t Au over 6.10m from 156.97m down hole in CCRC21-009. Four holes were completed at the Jeans Ridge target 1.4km to the northeast, with gold mineralization variably associated with weak chlorite alteration and associated bismuth, tungsten, tellurium, and arsenic. A peak value of 0.50 g/t Au over 1.52m was intersected in hole CCRC21-004 beginning at 45.72m down hole. The 2021 drilling did not explain the surficial anomaly and further work is warranted.

Qualified Person & QA/QC

Tectonic’s disclosure of a technical or scientific nature in this press release has been reviewed, verified and approved by Eric Buitenhuis, M.Sc., P.Geo., Tectonic’s Vice President Exploration, who serves as a Qualified Person under the definition of National Instrument 43-101.

The analytical work for the 2021 drilling program was performed by Bureau Veritas Laboratories (“BV”), an internationally recognized and accredited analytical services provider, which is independent of Tectonic. All samples were submitted to BV’s Fairbanks, Alaska facility where they were prepared using procedure PRP70-250 (crush, split, and pulverize 250g to 200 mesh). Pulp samples were then sent to Vancouver, Canada, where they underwent analysis for gold by method FA430, a 30-gram Fire Assay fusion with an atomic absorption finish (AAS). Samples returning >10 g/t Au were re-analyzed using method FA530-Au, a 30g Fire Assay with gravimetric finish. Additionally, a 0.25g pulp was analysed by four acid Inductively Coupled Plasma Emission Spectrometer (ICP-ES) for 35 elements using method MA300. A 0.25g pulp from all Reverse Circulation samples was analysed by four acid ICP-ES for 45 elements using method MA200.

Quality Assurance and Quality Control procedures include the insertion of coarse blanks and certified assay standards into the sample string at a rate of approximately 1/10 (10%). Samples are placed in sealed and security tagged bags and shipped directly to the BV preparation facility in Fairbanks, Alaska.

About Tectonic

Tectonic Metals Inc. is a mineral exploration company created and operated by an experienced and well-respected technical and financial team with a track record of wealth creation for shareholders. Key members of the Tectonic team were involved with Kaminak Gold Corporation, the Company that raised C$165 million to fund the acquisition, discovery and advancement of the Coffee Gold Project in the Yukon Territory through to the completion of a bankable feasibility study before selling the multi-million-ounce gold project to Goldcorp Inc. (now Newmont) for C$520 million in 2016. Tectonic is focused on the acquisition, exploration, discovery and development of mineral resources from district-scale projects in politically stable jurisdictions that have the potential to host world-class orebodies.

To learn more about Tectonic please click here.

On behalf of Tectonic Metals Inc.,

Tony Reda

President and Chief Executive Officer

For further information about Tectonic Metals Inc. or this news release, please visit our website at www.tectonicmetals.com or contact Tony Reda, President & CEO of Tectonic, or Bill Stormont, Investor Relations, at toll-free 1.888.685.8558 or by email at info@tectonicmetals.com.

Facebook: https://www.facebook.com/TectonicMetals/

Twitter: https://twitter.com/TectonicMetals

Instagram: https://www.instagram.com/tectonicmetals/

LinkedIn: https://www.linkedin.com/company/tectonic-metals

Cautionary Note Regarding Forward-Looking Statements and Historical Information

Certain information in this news release constitutes forward-looking information and statements under applicable securities law. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as “may”, “should”, “anticipate”, “expect”, “intend” and similar expressions and include, but are not limited to, statements with respect to the potential for mineralization at Tectonic’s projects, planned exploration programs, and results of any future exploration activities. The Company makes no representation or warranty regarding the accuracy or completeness of any historical data from prior exploration undertaken by others other than the company and has not taken any steps to verify, the adequacy, accuracy or completeness of the information provided herein and, under no circumstances, will be liable for any inaccuracies or omissions in any such information or data, any delays or errors in the transmission thereof, or any loss or direct, indirect, incidental, special or consequential damages caused by reliance on this information or the risks arising from the stock market.

Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining governmental and other approvals and financing on time, obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, accuracy of any mineral resources, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Tectonic, and there is no assurance they will prove to be correct.

Although Tectonic considers these beliefs and assumptions to be reasonable based on information currently available to it, they may prove to be incorrect, and the forward-looking statements in this release are subject to numerous risks, uncertainties and other factors that may cause future results to differ materially from those expressed or implied in such forward-looking statements. Forward-looking statements necessarily involve known and unknown risks, including, without limitation: the Company’s ability to implement its business strategies; risks associated with mineral exploration and production; risks associated with general economic conditions; adverse industry events; marketing and transportation costs; loss of markets; volatility of commodity prices; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; industry and government regulation; changes in legislation, income tax and regulatory matters; competition; currency and interest rate fluctuations; and other risks.

Readers are further cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. Although Tectonic has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Tectonic does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.